How to File Income Tax Returns Online?

Filing your income tax return (ITR) is a legal requirement and a key aspect of sound financial planning. Fortunately, you do not have to wait in queues or complete long forms anymore. You can also file income tax returns online from your home.

In this guide, we will go through filing income tax returns online, required documents, due dates, and FAQs to make your process smooth and seamless.

Why File Income Tax Return Online?

Filing online beneficial because its :

- Quick processing and refunds

- Accurate calculations with pre-filled data

- Easy recordkeeping and access

- Mandatory for income above the threshold limit

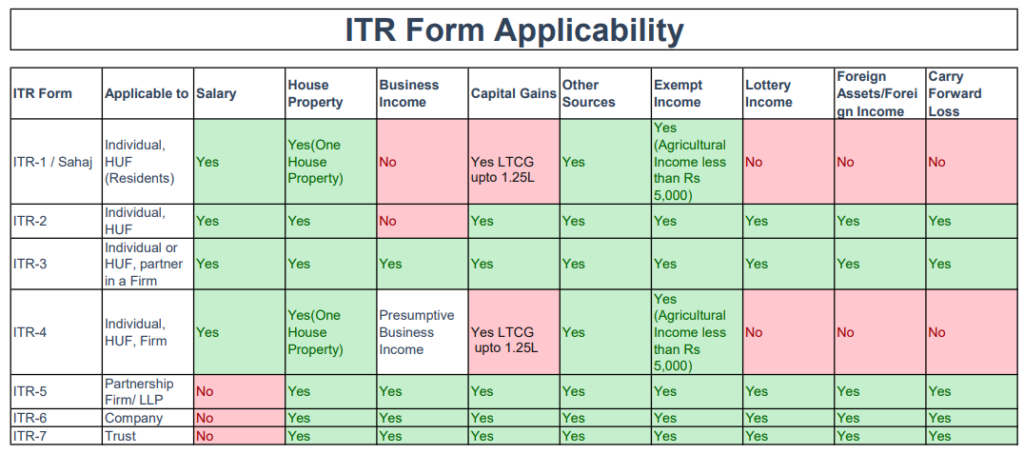

ITR filling applicability:

Step-by-Step Guide: How to File Income Tax Returns Online

Step 1: Register or Login on the Income Tax Portal

- Visit:https://www.incometax.gov.in

- If you’re new, register using your PAN. If already registered, just log in.

Step 2: Choose the Correct ITR Form

There are different ITR forms like ITR-1, ITR-2, etc. based on your income source:

- ITR-1 (Sahaj): For salaried individuals with income up to ₹50 lakh

- ITR-2: For those with capital gains or foreign income

- ITR-3/4: For business or professional income

Use the portal’s help section or consult a tax advisor if unsure.

Step 3: Select the Filing Mode

You can file:

- Online (recommended): Pre-filled data is available, easier for salaried individuals.

- Offline: Utility software can be downloaded and the form can be filled manually.

Step 4: Enter Required Details

- Verify personal info

- Enter income details (salary, house property, capital gains, other sources)

- Claim deductions under 80C, 80D, etc.

- Review taxes paid (TDS, advance tax)

Step 5: Validate and Submit

- After completing the form, validate all details.

- Click Submit.

- If taxes are due, pay via the portal before submission.

Step 6: E-Verify Your Return

Post submission, verify it electronically:

- Using Aadhaar OTP

- Through Net Banking

- Using EVC via bank account/Demat

- E-verification is mandatory to complete the process.

Important Documents Required

Keep these handy:

- PAN, Aadhaar card

- Form 16 (for salaried)

- Bank account details

- Interest certificates (FD, savings)

- Investment proofs (LIC, ELSS, PPF)

- Home loan or rent receipts (if applicable)

Due Dates for Filing Income Tax Return

| Category | Due Date |

| Individual (Non-audit cases) | 31st July 2025 |

| Businesses requiring audit | 31st October 2025 |

| Revised/Belated Return | 31st December 2025 |

Note: File before the due date to avoid penalties and interest.

FAQs

1. Do I have to file ITR if my income is below the exemption threshold?

No, but it is recommended for visa, loan sanctions, and refunds.

2. Can I make changes to my return after submitting it?

Yes. You may make changes to it online before 31st December of the year of assessment.

3. What happens if I fail to meet the due date for filing ITR?

You can submit a belated return with late charges.

4. How do I check my refund status?

Log in to the portal and look under “View Returns/Forms” > “Refund Status.”

5. Is Aadhaar linking required for e-filing?

Yes. Aadhaar linking with PAN is required prior to filing.

Growthinfy’s Tips

- Always recheck your income and deductions.

- Use a secure internet connection when filing income tax returns online.

- Take help of a tax professional if you have more than one source of income.

Following this guide, you can simply know how to file income tax returns online without any confusion. Keep yourself updated with due dates and keep your documents in place to make your filing smooth and timely.