Top Investment Options in India for 2025: Safe and High-Return Plans

Investment in 2025 may play an important role for all Indian investors looking to build wealth for a better financial future as the cost-of-living rises alongside our economic growth. Given that inflation rates continue to hover between 5-6% annually, selecting appropriate investment choices available in India can help create that wealth needed for specific goals that include retirement, higher education, or buying a home. This guide will provide Indian investors with safe money, good, and better investment choices available to them based on their risk profile and financial goals.

Why Invest in 2025?

India’s economy is expected to grow, at least at 6.5- 7% in 2025, a potential bonanza for its investors. With rising expenditures for healthcare, education and shelter, hence, financial plans are paramount. By investing sensibly, couples, families and individuals can selectively invest and achieve their various milestones and challenge the impact of inflation.

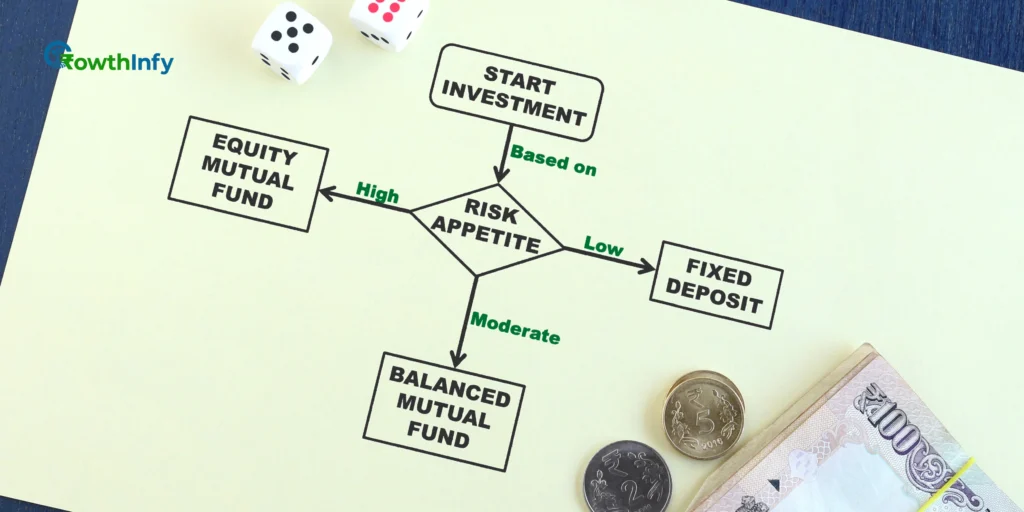

Initially take stock of your risk profile, your investment horizon and your aims. Diversification, across asset classes, helps to mitigate risk and enhance returns! Here are some investment plans for 2025.

Safe Investment Options in India

1. Public Provident Fund (PPF)

Public Provident Fund (PPF) is one more example of a government-supported scheme with a guaranteed interest rate of 7.1% (in the year 2025) and the ability to receive tax benefits of the amount contributed under Section 80C (up to ₹1.5 lakh). As one would expect, this scheme has a lock-in period of 15 years, which is suitable for long-term plans such as retirement or children’s education.

This scheme offers steady returns while ensuring safety for the capital amount. Although partial withdrawals are allowed after 7 years, there is still some liquidity; therefore, PPF is for the more conservative investors.

2. Fixed Deposits (FDs)

FDs, provided by banks and post offices, are among the safest investment options in India. They have an interest rate between 6 – 8%, and senior citizens may get 0.5% above these rates. There are tax-saving FDs offering the benefit of Section 80C for 5-years maturity and a lock-in period.

FDs offer predictable returns and a flexible term (7 days to 10 years). But since the interest will be taxable, you may want to know your tax slab before investing in it.

3. National Savings Certificate (NSC)

NSC is a Post Office-run scheme that offers a 7.7% interest rate with a 5-year lock-in period. Tax deductions are available up to ₹1.5 lakh under Section 80C for investments. The investment is ideal for a mid-term saving goal such as a wedding or education costs.

Interest is compounded annually, but it is payable at maturity and the capital is protected. It is also accessible through Post Offices, making it a popular scheme in rural parts of India.

Good Investment Options in India

4. Sovereign Gold Bonds (SGBs)

Gold is both a cultural and financial asset in India. The SGBs from RBI pay 2.5% interest annually, with capital appreciation linked to gold prices. They’re 8 year in duration with maturity exempt from taxes, making them a better investment option in India than physical gold.

Storage costs and risks are not an issue with SGBs. Investors can buy them from the bank or stock exchanges, starting at one gram.

5. Sukanya Samriddhi Yojana (SSY)

SSY promotes the welfare of Girl children through a Government scheme. As per 2025 interest rate, SSY has a rate of interest of 8.2%. SSY has a tenure of 21 years, and the Government also covers tax benefits specified in Section 80C. SSY is a perfect scheme for parents that are planning for education and/or wedding related expenditure.

The minimum investment is ₹250, and you can invest up to ₹1.5 lakh in a given year.

Withdrawals are permitted in part starting at 18 years of age for the girl.

Better Investment Options in India

6. Mutual Funds

Mutual funds can accommodate a wide variety of risk profiles, so they are a solid option for 2025. Equity mutual funds produce approximately 12-15% average returns for those in the highest risk profile and debt funds are suitable for more conservative investors, producing returns of 6-8%. Equity-Linked Savings Scheme (ELSS) is a hybrid mutual fund that doesn’t just provide returns, but (in addition) offers tax savings with a lock-in of only 3 years.

Mutual funds are accessible. They are accessible due to their systematic investment plan (SIP) – a method of investing that starts at ₹500 and is used by millions. Attractive fees (partly due to their professional management) and the ability to diversify are also reasons to perceive mutual funds as a better investment in India.

7. National Pension System (NPS)

NPS is a retirement scheme indexed to the markets, with a possible return of between 9-12% based on the allocation of equity, debt, or hybrid investments. Contributions toward NPS are tax-deductible subject to limits of ₹2 lakh under Sections 80C and 80CCD(1B).

The structure allows investor flexibility to choose asset managers and asset allocation. Partial withdrawals for specific events (education or medical expenses) offer liquidity to the investment, which makes it appropriate for long term wealth creation.

High-Risk, High-Return Options

8. Equity Stocks

When it comes to returns on investment (ROI) stocks have the greatest potential for returns (15 – 20% per annum) but are very volatile. Investing in blue-chip companies or indices (like NIFTY 50) helps mitigate risk.

Due diligence is necessary, especially if the long-term investing period is at least five years or more to avoid fluctuations in the market. Stocks investing is best suited for those with a higher risk tolerance and large increase in ROI.

9. Unit-Linked Insurance Plans (ULIPs)

Unit-linked insurance plans (ULIPs) offer insurance and investment in a single product with market-linked returns and life cover. Equity ULIPs can provide 10-15% returns and come with tax benefits under Section 80C and Section 10(10D).

Given that ULIPs have a 5-year lock-in and incur additional costs (1-2% a year) on top of management fees, it is important to choose your fund carefully. ULIPs are appropriate for investors looking for the benefits of both insurance and wealth creation.

Case Study: A Balanced Approach for Indian Investors

Take the example of Sumit and Sumedha, a young couple from Mumbai, whose combined income is ₹1.5 lakh. They want to save for their home down payment (₹10 lakh in 5 years) and retirement in that same period.

They have a diversified portfolio:

- PPF (₹1.5 lakh each annually): The safety aspect; and also tax saving aspects.

- Equity Mutual Funds (₹10,000 SIP): aimed at high returns for long time goals.

- SGB’s (₹50,000 annually): To hedge against inflation

- FD’s (₹2 lakh): Emergency fund for unplanned expenses

This reasonably-opportunistic portfolio pulls effectively against their investments goals, while providing a healthy opportunity for risk-return for them simultaneously.

They have regular reviews with their SEBI-registered advisor to keep their plan on track.

Tips for Choosing the Best Investment Options

1. Assess Risk and Goals

Low-risk investors should opt for PPF, FDs, or SSY. Moderate-risk investors can explore mutual funds or SGBs, while high-risk takers may choose stocks or ULIPs. Align investments with goals like buying a home or funding education.

People who want low-risk investments should consider PPF, FDs, or SSY. Moderate-risk investors can choose mutual funds or SGBs, while those who can tolerate a high-risk may select from stocks, ULIPs. Your investments should always be made in line with your investment objectives, like buying a house or funding an education.

2. Diversify Your Portfolio

Spread your investments across various asset classes to minimize the risk. For example, a good mix can be 40% to Fixed Deposits / PPF, 30% to mutual funds, 20% to SGBs, and 10% to stocks. This is effective in ensuring that you have a good investment stance during market fluctuations.

3. Maximise Tax Benefits

Also, utilize the various tax-saving investment options that are available such as PPF, ELSS, or NPS. If you are married, even though you invest individually you can benefit from tax savings of up to ₹3 lakh, this is available under section 80C of the income tax act. Plan early to avoid the artificial rush for tax-saving instruments at the end of the financial year.

4. Build an Emergency Fund

You should also have 6 to 12 months’ worth of monthly expenses in liquid assets such as savings accounts or liquid mutual funds. If your monthly expense is ₹50,000. You should aim to have at least ₹3-lakh to ₹6-lakh of liquid money available to meet emergencies, loss of work, or medical expenses .

Read our insightful article on Emergency Funds to understand why they’re a crucial part of a solid financial plan.

Common Mistakes to Avoid

- Over-Reliance on One Asset: Don’t put all your eggs in one basket with deposits or stocks; diversify.

- Ignoring Inflation Risk: Choose investments (like equity funds or SGBs) that will give you a return above inflation (5-6%).

- Lack of Research: Be informed about what you’re investing in, especially regarding high-risk investments like stocks.

- No emergency fund : Lack of liquidity can disturb your financial plans when events occur.

Conclusion

To choose the best investment options in India in 2025 requires an evaluation of protection of the capital, returns and objectives. In the case of capital protection, you have options like PPF, FDs or SSY and are suited to those that are conservative investors; if you are willing to take on some risk you have options such as mutual funds, NPS or stocks that offer higher returns. In conclusion: diversify your investments, plan for taxes and seek guidance from a SEBI registered advisor to create a solid portfolio. Start investing now to secure your financial future!

Pingback: Zero-Based Budgeting: Spend Smarter Every Month