Understanding the Reverse Charge Mechanism in GST: A Comprehensive Guide

A reverse charge mechanism is a significant element for businesses in India that are handling GST (Goods and Services Tax). Ordinarily, in GST, Supplier collects the tax and pays to the Government. However, when reverse charge applies, the liability for the tax ordinarily performed by Supplier, is instead, the liability (obligation) of the recipient of goods or services. This article will explain what exactly is reverse charge mechanism in GST, when reverse charge applies, the applicable rules, and the examples as mentioned for Indian business owners or GST planning for business. With information and understanding of the reverse charge mechanism, present or future businesses (new start up business, a freelancer, or established company), whoever you are, will need to know the RCM concept to comply with GST.

What is Reverse Charge Mechanism in GST?

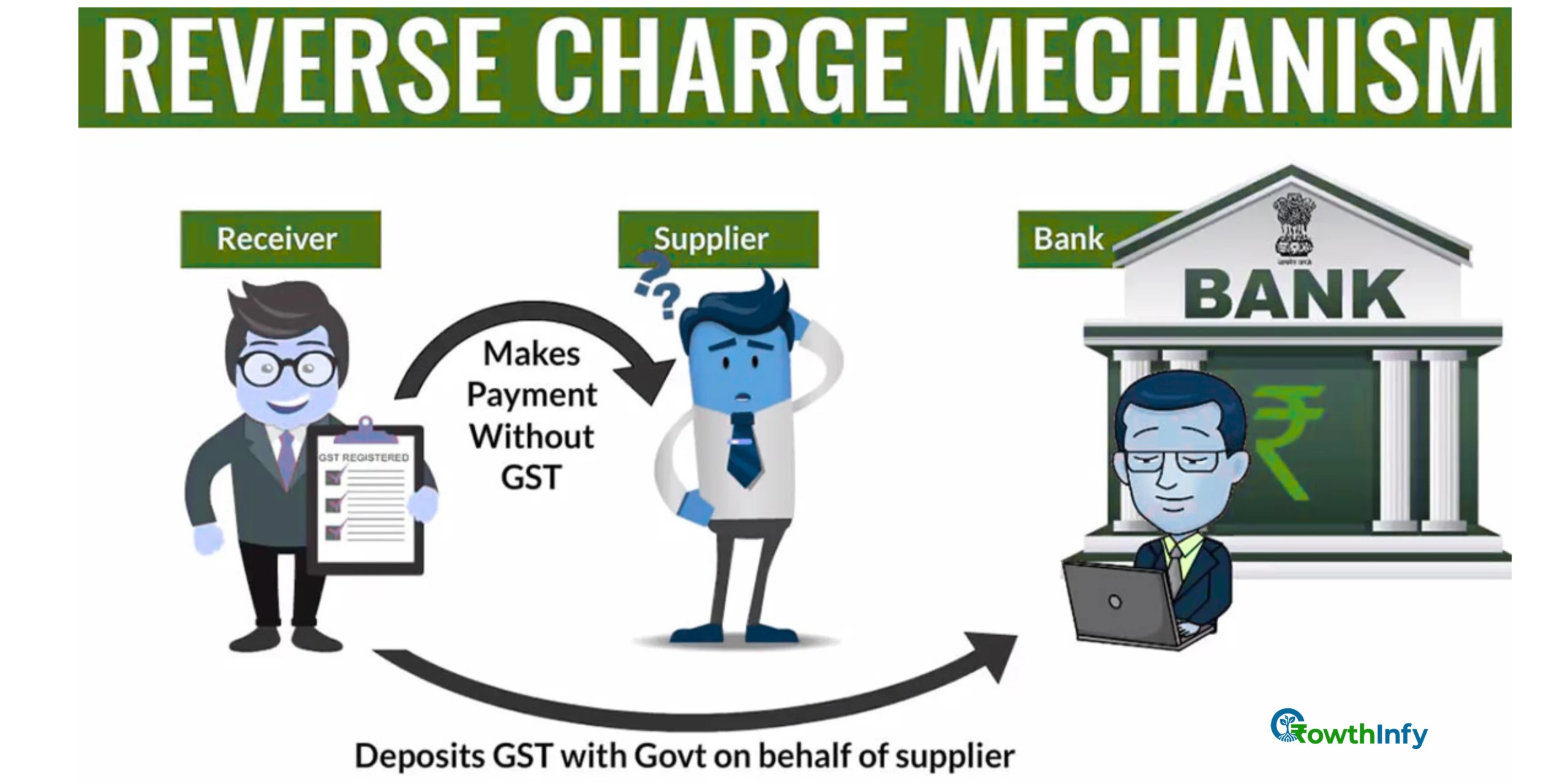

The reverse charge mechanism is a provision under the GST law where GST is payable to the Crown by the recipient instead of the supplier. In a normal transaction, the supplier collects GST from the buyer and pays it over to the tax office. With the reverse charge mechanism, the buyer is responsible for paying the tax directly to the tax office.

Reverse charge applies to specified goods, services, or circumstances set out in the GST Act. This is a way of ensuring tax compliance when the supplier is unregistered or the transaction involves specific circumstances, such as imports or services provided by unregistered dealers.

Why Was the Reverse Charge Mechanism Introduced?

The introduction of the reverse charge mechanism in GST serves as an effective way to streamline GST collection and compliance, particularly where collecting tax from the supplier would be difficult. The following list shows three key objectives:

- Improve Compliance: The reverse charge mechanism would collect tax where the supplier is completely unregistered or registered outside of India (i.e., Imports).

- Broadening the Tax Base: The reverse charge indirectly brings unregistered suppliers into the GST framework, since the recipient is required to bring the tax into account.

- Deter Tax Evasion: The reverse charge provides liability to only the recipient, thus decreasing the risk of tax evasion on a transaction-by-transaction basis

For businesses, understanding what reverse charge mechanism is helps avoiding penalties and complying with GST legislation.

When is Reverse Charge Mechanism Applicable?

The reverse charge mechanism in GST applies in specific scenarios as per Sections 9(3) and 9(4) of the CGST Act, 2017. Below are the key cases:

1. Supply of Notified Goods and Services

The government notified certain goods and services for which the reverse charge is obligatory. Examples include:

- Goods: Cashew nuts (whether shelled or peeled), Bidi wrapper leaves, Tobacco leaves.

- Services: Legal services provided by an advocate, GTA services, Sponsorship services.

2. Supply from Unregistered Suppliers

If a registered person obtains goods or services via a transaction from an unregistered supplier, the receiver must pay the GST associated with that transaction via reverse charge. However, the section (Section 9(4)) must be noted – the section is generally suspended for most registered persons, except in the manner notified by the government.

3. Import of Service

If a registered person obtains services from a supplier located outside India (for example, consultancy services or software services), the receiver is required to pay the GST associated with that transaction via reverse charge since it is considered as import of service.

4. Other specific cases

Certain transactions, like where a registered person rents a motor vehicle to a body corporate or the transaction is for services provided by an insurance agent, are also required to use reverse charge.

How Does Reverse Charge Mechanism Work?

Now that you have an idea of the reverse charge mechanism in GST, you can understand the steps involved in reverse charge mechanism.

- Identifying relevant RCM Transactions: The recipient identifies whether the transaction is RCM related (i.e., notified services or supplies from an unregistered dealer)

- Making the Payment: The recipient calculates the GST (CGST, SGST, or IGST) amount and directly pays it to the government in the appropriate GST returns (GSTR-3B format).

- Purchase of Goods/Service after Payment: If the recipient is eligible to claim Input Tax Credit (ITC) on the GST paid under RCM, as long as the goods or services are used in the furtherance of business.

- Invoicing: For RCM payments, the supplier issues an invoice free of GST and the recipient issues a self-invoice for the purpose of RCM.

For example, if a company hires an advocate to provide legal services, the company (the recipient) pays GST under the RCM mechanism and should be entitled to claim Input Tax Credit (if eligible).

Key Rules for Reverse Charge Mechanism Under GST

The Reverse Charge Mechanism under GST has some specific compliance obligations as follows:

1.Self-invoicing:

In the case of supply from unregistered dealers, the recipient must self-invoice for GST purposes.

2.Time of Supply:

The time of supply under RCM rules determines when the tax liability arises. For the supply of goods, the time of supply is the earliest of:

- The date of receipt of the goods.

- The date of payment.

- 30 days from the date of the supplier‘s invoice.

3. For the supply of services the time of supply is the earliest of:

- The date of payment.

- 60 days from the date of the supplier‘s invoice.

4. GST Registration:

Any business that is liable to pay tax under RCM must obtain GST registration, even if their turnover is below the threshold.

4. Record Keeping:

The recipient must keep adequate records when dealing with RCM transactions and report that in GSTR-1 and GSTR-3B.

Benefits of Reverse Charge Mechanism

The reverse charge mechanism provides advantages for businesses and government alike:

- Better Compliance: Ensures tax is collected where the supplier is unregistered or non-compliant.

- Convenience for Small Suppliers: Unregistered suppliers are relieved of GST compliance, providing an incentive for small businesses.

- ITC eligibility: Registered businesses can claim ITC for tax they pay under RCM, thereby lowering their tax liability.

- Transparency: RCM increases transparency in certain transactions, namely imports and notified services.

Understand Sponsorship Services under GST in our latest insightful blog.

Challenges of Reverse Charge Mechanism

The reverse charge mechanism in GST is, of course, an advantage; however, it does bring some challenges:

- Increased compliance burden: The recipient pays GST (after thinking it is GST-exclusive), further adding to the administrative burden.

- Cash-flow implications: The business pays GST to the supplier first and claims ITC later, affecting working capital.

- Complexity in tracking transactions: It can be complicated to identify the transaction that is subject to RCM, and to keep records, especially for small businesses.

Practical Examples of Reverse Charge Mechanism

Let’s take a look at the reverse charge mechanism in the real world.

- Legal Services: Suppose a company engages the services of an advocate to give legal advice. While the advocate does not charge GST, the company pays GST under RCM and files it in GSTR-3B.

- Goods Transport Agency (GTA): A business avails the services of a GTA to provide transportation of goods. The GTA issues an invoice without GST, and the business pays GST under RCM.

- Import of Services: A startup engages the services of a foreign consultant for marketing services. The startup pays IGST under RCM because of the import of service.

As you can see, RCM can apply to any business, big or small, from a startup to a multinational company.

Recent Updates on Reverse Charge Mechanism (July 2025)

As of July 2025, the government has not taken any significant decisions on RCM provisions, but businesses still need to keep abreast of notification from the government. For example, RCM on supplies from unregistered dealers (Section 9(4)) continues to be suspended, meaning that many business operators are relieved of compliance requirements. However, recently added provisions brought some services, such as renting motor vehicles to corporates under RCM, which had implications for industries such as logistics.

Keep up to date on GST changes by reading this Growthify Blog on GST changes.

Tips for Businesses to Manage RCM Compliance

To manage the requirements of Reverse Charge Mechanism under GST, businesses could consider the following methods:

- Make use of Accounting Software: Certified software like Tally or Zoho Books can automate RCM calculations and reporting.

- Regular Audits: Have regular GST audits every 3 to 6 months to ensure you account for all RCM transactions.

- Stay updated: Keep a watch on CBIC notifications for up-to-date information on goods and services applicable to RCM.

- Training: Train your finance department on RCM rules, to be aware of how to avoid mistakes in compliance.

Conclusion

In GST, reverse charge is an essential part of India‘s tax system, to ensure compliance for certain transactions, and ensure a wider tax base. Understanding what a reverse charge mechanism can help businesses comply with its rules, claim ITC, mitigate penalty risk. RCM (reverse charge mechanism) may complicate things but having appropriate systems and knowledge will allow you to comply easily. Organisations must stay alert, take advantage of technology, and visit Growthify‘s content on GST compliance!

If you’re interested in learning more about how to make your startup scalable and tax-compliant, follow Growthify‘s LinkedIn page, and check out our blogs to see how!