GST Penalties: Types, Appeals & Avoidance Tips

GST penalties & appeals: Types and How to Avoid Them

Since the Goods and Services Tax (GST) came into existence in 2017, it has consolidated the indirect tax system of India. On the one hand, it has made compliance easier, but on the other hand, even small errors can lead to the imposition of fines and the accrual of interest, which in turn may result in the unexpected financial and legal consequences. Thus, it is essential for businesses to understand GST penalties in order to keep up with compliance and to prevent making expensive errors

Types of GST Penalties

GST penalties are addressed in Section 122 of the CGST Act. There are 21 distinct offences listed, ranging from trivial inaccuracies to elaborate fraud.

Trivial breaches of obligation relate to tax declared due of less than ₹5,000 in tax. There are no penalties; however, voluntary disclosures are incentivised to ease the penalty burden.

Serious breaches of obligation trigger stricter mitigations. Failure to file returns on time draws the most significant penalty, set at ₹50 per day (₹25 CGST and ₹25 SGST) up to a maximum penalty of ₹5,000.

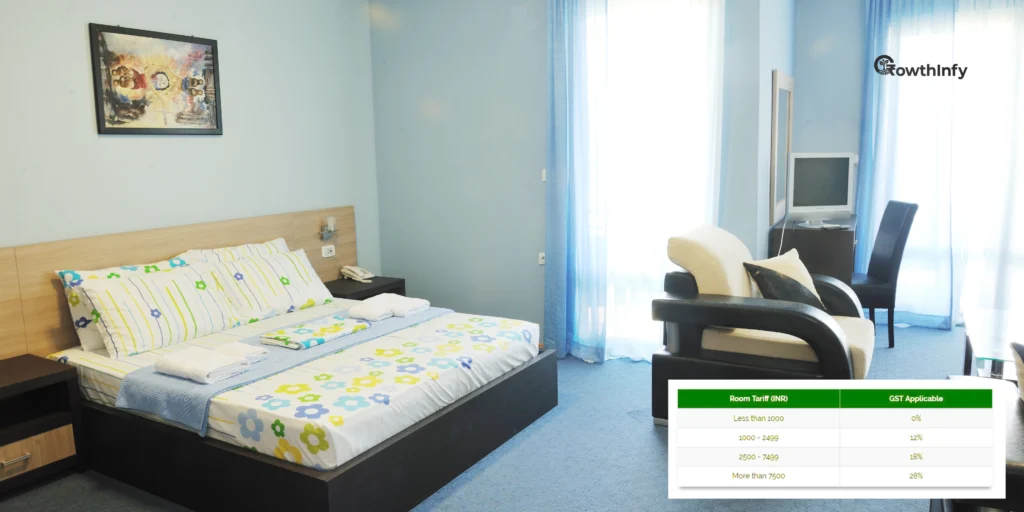

Type of Penalty | Description | Amount |

Late Fee for Returns | Delayed GSTR-1 or GSTR-3B filing | ₹50/day (max ₹5,000) |

Interest on Delayed Payment | Late tax remittance under Section 50 | 18% p.a. on unpaid tax |

General Penalty | Any unspecified offence | Up to ₹25,000 |

Tax Evasion Penalty | Fraudulent ITC claim or suppression | 100% of tax evaded |

Non-Registration Penalty | Supplying without GSTIN when liable | 10% of tax or ₹10,000 (whichever higher) |

This table illustrates shared GST penalties. This sheet can be used as a preliminary reference for compliance and checks.

Fraud cases such as issuing false invoices incur a 100% penalty on the tax amount, and repeat offenders can be subject to prosecution.

Prosecution occurs for serious violations, where a jail sentence can range from 6 months to 5 years, emphasizing the laws deterrent intent.

Latest Developments in GST Penalties (2025)

The Finance Bill, 2025 introduces significant measures that are effective as of 1 October 2025. The new Section 122B introduces penalties for failure to comply with the Track and Trace Mechanism previously established under Section 148A, targeting evasion involving particular “high-risk“ goods including tobacco and pharmaceuticals.

The new procedure also allows a taxpayer to pay only 10% of the penalty in respect of a penalty assessment when appealing, as opposed to the previous required deposit of 25%. This reduces a barrier to access the GST appeals process for cases that are otherwise genuine.

The GST Appellate Tribunal (GSTAT) Rules, 2025 will assist in the organization of appeal procedures. Non-legal non-constitution issues can now be heard in single-member benches which speeds up the hearing process dealing with non-legal matters.

There is a newly introduced amnesty under Section 128A which waives interest and penalties if taxpayers, who were assessed for FY 2017-18 to 2019-20, pay full tax between 1 October 2023 and 31 March 2025.

These measures reiterate a key tenet of GST 2.0: ease of business. Businesses will be required to update their systems as much as required in advance of October 2025.

The GST Penalties & Appeals Process

Unhappy with a penalty order? Ensure you file a GST appeal within three months of receiving communication.

The structure begins at First Appellate Authority (Commissioner rank). You must submit Form GST APL-01 with a 10% pre-deposit of the disputed tax amount (or 10% of the penalty amount for penalty only cases).

If your appeal is unresolved, you have one month to escalate to GSTAT. The pre-deposit would be 20% of the remaining disputed tax, and maximum of ₹50 lakh.

Appeals to High Court occur if there is a substantial question of law. The Supreme Court is available as a last resort.

High Court appeals follow on substantial law questions. Supreme Court is the final recourse.

Appeal Level | Time Limit | Pre-Deposit Requirement | Form |

First Appellate Authority | 3 months | 10% of disputed tax/penalty | APL-01 |

GST Appellate Tribunal | 1 month from FAA order | 20% of remaining (max ₹50L) | APL-02 |

High Court | 180 days | As per court rules | Petition |

Supreme Court | No limit | As per court rules | SLP |

This table simplifies the GST appeals ladder. Note: Extensions up to one month are possible for sufficient cause.

Manual filing is allowed, as per Andhra Pradesh High Court ruling.

How to File a GST Appeal: Step-by-Step

- Log into the GST portal. Navigate to Services > User Services > My Applications.

- Select ‘Appeal to Appellate Authority’. Enter ARN, order details, and upload grounds of appeal.

- Pay pre-deposit via Electronic Cash Ledger. Submit and track via ARN status.

- Prepare strong evidence: invoices, ledgers, and legal precedents. Engage a GST consultant for complex cases.

Post-2025, partial withdrawals are allowed for specific periods. This offers flexibility.

Explore our detailed post on GST Appellate Tribunal Rules 2025 for procedural nuances.

Strategies to Avoid GST Penalties

Prevention beats cure.

- Making sure to file your returns on time through the use of automated tools. GSTR-3B filing deadlines are 20th to 24th of each month. Failure to file on or before that will activate blocks on future filings.

- Reconcile the input tax credit (ITC) on a monthly basis through GSTR-2B with GLS. This will allow you to catch any mismatches early on and avoid penalties of 100% of the liability for evasion.

- Train on e-invoicing and Track & Trace. Non-compliance will create new fines under Section 122B.

- Consider voluntary disclosure where possible to potentially reduce penalties by 50% or more. Also, keep good records for future audits.

- For small and medium sized enterprises, use GST Suvidha Providers, which are free. Conduct regular audits so as to be in front of the upcoming risks.

GST penalties provide a safeguard for the system but can strain the businesses. By understanding the types of penalties, understanding the GST appeals process, and implementing good habits, you can work through penalties successfully.

The reforms in 2025 will usher in a fairer regime. Keep an eye out for official opportunities for updates, including website portals.

Unsure what to do with your returns? Check out our article on Interest on Delayed GST Payments under Rule 88B.