Tax-Saving Tips for Small Business Owners in India

Tax-Saving Tips for Small Business Owners in India

Owning a small business in India can be difficult, and managing taxes is usually one of the most challenging aspects. With good planning, a small business owner can legally reduce tax liabilities to have more money for growth. This article covered actionable tips for reducing taxes meant for Indian entrepreneurs. They are meant to be ways to answer the question of how a small business lowers taxes and be compliant with The Income Tax Act, 1961. Let us now look at some practical tax saving tips for business owners to improve their profits in 2025.

Choose the Right Business Structure

The tax obligations associated with your business will largely depend on the entity’s structure. The sole proprietorship is taxed at the individual’s income tax slabs, which can be as high as 30% plus cess for higher income ranges. Whereas, a Private Limited Company’s tax obligation can opt for a concessional tax rate of 22% in terms of Section 115BAA.

Limited Liability Partnerships (LLP) are taxed at a flat rate of 30%. Your tax obligation and your business’ appearance as a professional business can be greatly enhanced by the choice you make in this regard. You are advised to seek guidance from tax practitioner or professional who can assist in establishing your structure for tax purposes and aligning it with your long-term objectives for your business.

Leverage Section 80C Deductions

Small business owners can claim deductions of up to ₹1.5 lakh per year under Section 80C by investing in the Public Provident Funds, Equity Linked Saving Schemes, or National Savings Certificates. These investments not only reduce your taxable income, but they also allow you to build wealth over time. For instance, ELSS funds generate market-linked returns with a 3-year lock-in, making them appealing to entrepreneurs. If your business is a sole proprietorship, just double-check that the investments are in your name.

Claim Business Expenses

Proper documentation of business expenses is key tax saving strategies for the business. Some business expenses such as your office rent, salaries to employees, and business travel are completely deductible if used solely for a business purpose. If you are operating in a home office, you can also claim a portion of an expense for things like electricity, internet and rent! You should maintain all of your documentation including receipts and invoices to support your business expenses when it is time for your tax audit. Make sure to use a digital payment method for anything over ₹10,000 to ensure the deduction applies to those items, as cash payments may be disallowed in that amount!

Depreciation on assets, such as computers, machinery or vehicles used in a business, can significantly decrease taxable income. For example, under section 35AD, if you are in the manufacturing business you can claim an additional 20% depreciation on new machinery in year one. If you purchased a new embroidery machine for your clothing business, the machine would be eligible for both the regular depreciation(15%) and the additional depreciation(20%). To ensure you receive the full benefit of this depreciation, make sure the asset is used 100% for business purposes and document usage appropriately. Further, because depreciation does not have any cash outflow, this benefit is considerable.

Opt for Presumptive Taxation

Presumptive taxation under Section 44AD is available to small businesses with an annual turnover of less than ₹2 crore. The presumptive taxation scheme allows you to report income as 8% of cash receipts or 6% or digital receipts, without the need for maintenance of detailed records/common bookkeeping or completing a legal tax audit. Professionals such as consultants or designers can report 50% of gross receipts as their income using Section 44ADA. It is a popular scheme for small-scale business owners as it simplifies compliance and minimizes tax compliance costs.

Deduct Tax at Source (TDS)

If you do not deduct TDS from your payments, for example, to pay commissions, rents or professional fees, then that payment could become un-deductible, meaning that your tax implications on that could be increased. For instance, if you paid ₹3 lakh as a commission but did not deduct 10% TDS, then you would have disallowed ₹90,000 which is 30% of your expense. All you needed to do was pay TDS correctly and your tax return would include the deduction. Therefore, ensure TDS is deducted and filed quarterly, stay compliant and able to claim reductions from your taxes as a small business. This is crucial aspect but sometimes overlooked by how a small business reduces taxes.

Employ Family Members

Hiring family members to perform legitimate functions can reduce taxable income to the business. For example, if you paid your spouse or child an annual salary of ₹2.5 lakh (and they had no other income), that salary would be tax-free for them, and claimable as a deduction to your business. It is essential that there is a formal role and documentation of the service and hours worked since tax inspectors may inquire into related-party transactions. However, this strategy allows you to have a free stream of income, reduces your overall tax liability, and tends to spread income.

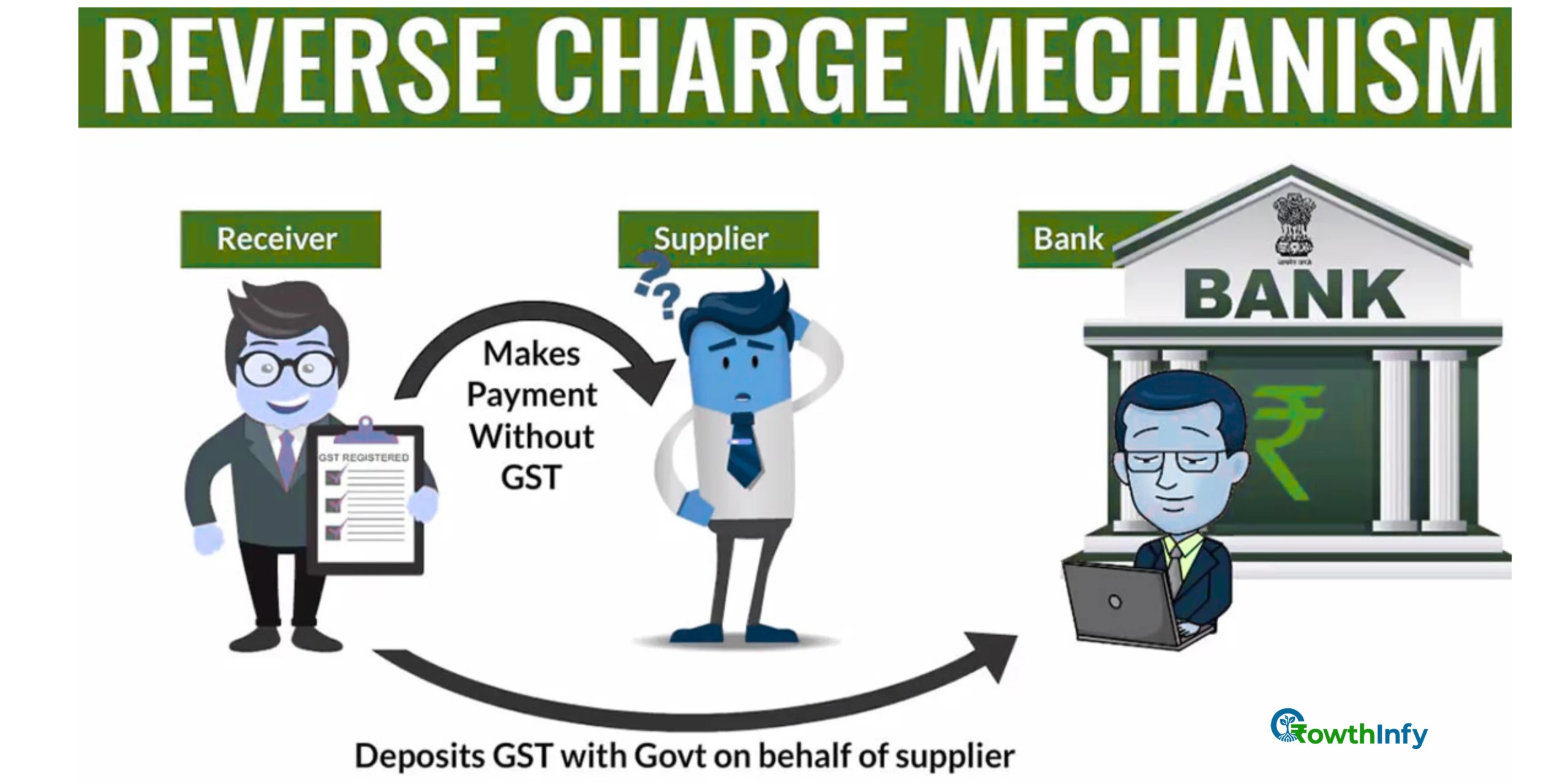

Claim Input Tax Credit (ITC) Under GST

If your business is GST-registered, claiming Input Tax Credit on purchases made for business will reduce your GST liability. For example, if you purchase raw materials or services and pay GST, you can claim back what you paid in GST and offset it from the GST you have collected from your customers. Make sure you are claiming these expenses as capital expenses, not business expenses, to be eligible for ITC. It’s important to ensure proper invoicing and ensure compliance with GST rules and regulations, to get the maximum benefit under GST.

Invest in Health Insurance

Under Section 80D, premiums paid for health insurance for yourself, your spouse, children, or dependent parents are deductible up to ₹25,000 (or ₹50,000 in the case of senior citizens). It gives you a way to not only secure your family healthwise, but it also saves your taxable income. For example, if you take a family floater policy and the premium is ₹25,000 – only in premium you will pay only ₹25,000 as tax deductible from income. So you get both benefits.

Donate to Charities

Donations to registered charities or registered funds, for example, the Prime Ministers Relief Fund, satisfy the requirement for Section 80G deductions. These donations are not exempt from a maximum of ₹1.5 lakh in deductions per year, which helps you receive a tax deduction and support charitable causes. Just retain your donation receipts, and prepare them for any tax compliance check. This is a straightforward way to reduce your tax.

Maintain Proper Bookkeeping

Keeping a precise account of your income and expenses is important for claiming deductions and eliminating any penalties, giving that you should use accounting software to quickly record your income, expenses, and taxes imposed. Paying municipal taxes or wages electronically means you now have a record of your payment confirmation, regardless if the original receipts from municipal offices is lost. Having regular meetings with a tax consultant are key opportunities to find additional savings and ensure you are complying with ongoing tax laws.

Plan for Retirement

Contributing to retirement plans like the National Pension System (NPS) allows you to claim deductions under Section 80CCD up to a limit of ₹50,000, in addition to the limits under Section 80C. By investing in retirement funds, you are building security for your future and reducing your current tax bill. For example, a small business owner could set up an employer-sponsored retirement plan, like a SEP IRA, to help reduce social security tax deductions for employees, while providing the benefit to both employees and employer, additionally assisting with employee retention.

Using these suggestions, a small business owner in India can legally reduce their tax liabilities while simultaneously helping to grow their future. Regular consultation with tax professionals and an understanding of information and reports available on changes to tax laws are critical in utilizing some of these items and implementing best practices for your business. Take time today to plan to save taxes, keep more of your hard-earned money, and grow your business and the economy in 2025.

6. National Savings Certificate (NSC)

6. National Savings Certificate (NSC)