GST in Hospitality Industry: Hotels & Restaurants in India

The hospitality sector in India – comprising of hotels, restaurants, and tourism – operates in a delicate balance of prices, compliance, and customer experiences. One of the key factors that is influencing that balance now, is GST. GST rates vary for hotel stays and restaurants, and this creates opportunities and challenges for hospitality stakeholders alike. From the perspective of consumers travelling to India, GST influences their affordability; Its effects can impact the competitive and growth landscape for key players (hotels & restaurants). Industry bodies, including the Hotel Association of India (HAI) are now advocating for GST rationalisation and have argued that creating a fairer tax for hospitality could allow Indian hospitality to take off on an international stage. This article will elaborate on what we know as of August 2025.

What is GST in the Hospitality Industry?

The GST in the hospitality sector replaced a multiple overlapping of taxes with a one-fits-all system, however the multi-tiered rates have complicated things. Hotel rooms in India incur GST of 0% to 18%, while restaurants will have GST that is either 5% or 18% depending on how they are set up. These rates are passed on as operating costs or shown on the bills provided to customers, which affect the growth trajectory of the sector thus far. Hospitality contributes 6–7% of India‘s GDP and employs in excess of 45 million people, making this sector a key contributor to the economy.

The industry faced some challenges including compliance challenges and higher tax rates especially after the COVID pandemic, and, as noted in HAI’s August 2025 statement regarding their considered reforms, they advocate to ease GST in order to increase tourism and work towards a more competitive environment. The GST Council is still in discussions for possible changes in the future.

GST on Hotel Room Rent: Structure and Impact

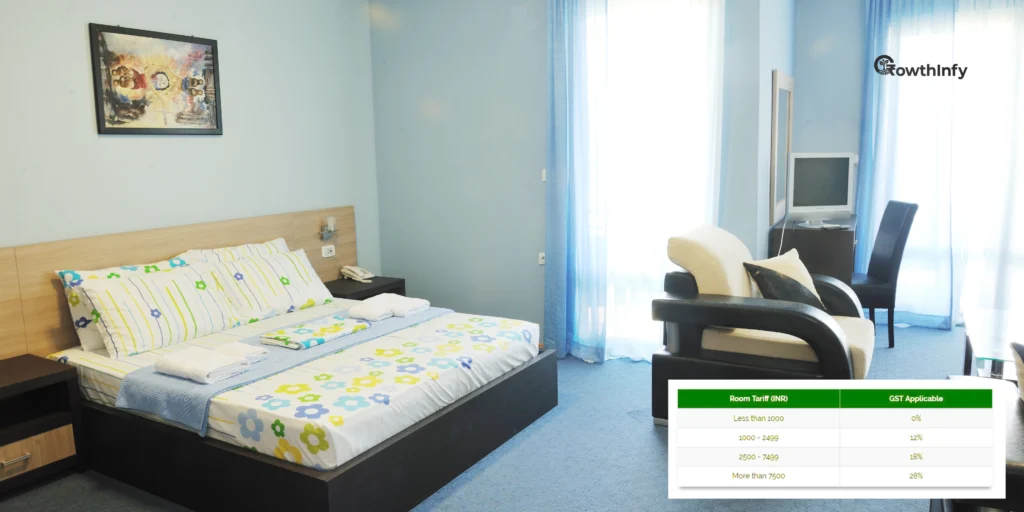

The GST on hotel room rent is tiered based on the room tariff per night:

- 0% GST: Tariffs below ₹1,000.

- 12% GST: Tariffs between ₹1,000 and ₹7,500.

- 18% GST: Tariffs above ₹7,500.

The structure makes budget hotels affordable but increases costs for mid and luxurious segments. A room priced at ₹10,000/night incurs ₹1,800 in tax as GST, and prices increase for customers. HAI points out high rates impact domestic travellers who are 80% of bookings and make India less competitive compared to tourism destinations like Thailand (7% VAT).

In August 2025, HAI reiterated their call for a common GST rate of 12% across all hotels, as the projected occupancy increased by 15–20%. A combination of taxes or simplified taxes could lower prices 5–10% and increase affordability.

GST on Restaurant Food: Dining Dynamics

Restaurants face two GST rates:

- 5% GST: Non-air-conditioned eateries or those without Input Tax Credit (ITC).

- 18% GST: Air-conditioned restaurants, including those in hotels, with ITC eligibility.

The GST applied to restaurant food has considerable consequences on pricing. Adding ₹180 GST onto a ₹1,000 meal at fine-dining restaurant, and ₹50 on a meal at a hole-in-the-wall, means the price paid by customers can vary greatly. This affects the footfall and revenues of mid-tier restaurants, which is the majority category of restaurants in India. The National Restaurant Association of India (NRAI) reported that 65% of restaurants faced issues of ITC compliance, which only increased costs to the restaurant.

HAI and NRAI suggest a uniform GST rate of 12% so that restaurant affordability can comply with ITC regulations. If successful, predetermined revenues could increase by 10–15% for restaurants in tourist spots like Mumbai and Jaipur, according to a 2025 NRAI survey.

Table: GST Rates in Hospitality Industry

Service | GST Rate | Conditions |

Hotel Room (Below ₹1,000) | 0% | No ITC allowed |

Hotel Room (₹1,000–₹7,500) | 12% | ITC allowed |

Hotel Room (Above ₹7,500) | 18% | ITC allowed |

Restaurant (Non-AC) | 5% | No ITC allowed |

Restaurant (AC/Hotel) | 18% | ITC allowed |

This table illustrates the complexity of GST rates, driving the need for simplification.

GST and Tourism: A Global Perspective

Tourism, an important part of the hospitality industry, is also affected by GST. Services like tour packages as well as car rentals are subjected to 5–18% GST in India causing the outcome to be less competitive than other countries. To illustrate, we take a ₹50,000 tour package that attracts the maximum of 18% GST of ₹9,000. Compare that to packages in Malaysia with only a 6% tax or cheaper packages. HAI made a statement in August 2025 that if the GST rate was at 12% rather than the current provisions, India could attract 15 million more foreign tourists per year and assist in the intended $50 billion of tourism revenue desired by 2028.

The GST in the hospitality industry also hinders sustainable tourism. Eco-friendly hotels are affected by the GST regime including standard rates but HAI is looking at tax incentives for hotels and restaurants that received green certifications.

Challenges in the Current GST Framework

The GST in hospitality industry dues presents several challenges:

- Compliance Cost: Small businesses incur compliance costs of about 2–3% of their revenue due to classification disputes, shifting sands in the rules around ITC, and restricted timeframes, as per a FICCI report from 2025.

- High Rates: With the GST rates at 18%, there is a cost push for restaurants and luxury hotels, resulting in a further decline in demand.

- The Government of India’s concerns regarding ₹12,000 crore in revenue losses if rates are reduced, seems rather hypocritical as it generated ₹60,000 crore from the hospitality industry alone in FY 2024–25.

New HAI has suggested a standard GST rate of 12% so that compliance becomes simpler and more affordable and, in turn, lead to higher demand and consumption which would mitigate the projected revenue losses inflicted by an even smaller GST rate.

Recent Developments: HAI’s Advocacy and GST Council Updates

HAI welcomed the GST Council‘s renewed focus on rationalization in August 2025 after the 54th GST Council meeting held in July 2025. HAI data revealed revenue growth potential of 20% for the sector if a uniform 12% rate for hospitality is pursued by the GST Council. However, HAI noted that the Finance Minister Nirmala Sitharaman reiterated the need for the appropriate balancing of industry needs with fiscal stability demonstrating hospitality‘s employment growth, creating 10 million jobs by 2030.

The Union Budget 2025 also underlined tourism-led growth and that had schemes such as Swadesh Darshan 2.0 in place to authorise funding for infrastructure. HAI noted the potential of hospitality with its proposal that suggested a 25% rise in the hospitality sector contribution to the total GDP by 2028.

Future Outlook: Transforming Indian Hospitality

A unified Goods and Services Tax system in the hospitality sector could propel India‘s tourism industry into world leadership status. If the rate were set at 12%, India would be aligned with countries like, for example, the UAE (5% VAT) and Singapore (8% GST), creating more competitive advantage. If the hospitality tax structure was simplified, industry analysts are predicting revenues from hotels and restaurants would increase by 15 to 20 percent from the reforms within two years. A simplified tax structure is also expected to attract foreign investment for hospitality infrastructure.

We might expect the GST Council to come to final decisions in the next meeting, scheduled for September 2025. This meeting will entertain tax incentive pilot projects regarding the green tax. The GST reforms will be vital in meeting India‘s goal of 30.5 million foreign tourism visits to India by 2028.

Conclusion

The GST changes in the hospitality industry is a key factor in determining the future of Hotels, Restaurants, and Tourism in India. The industry has faced many challenges in terms of growth due to the high rates of GST and compliance complexity, but HAI‘s efforts to have a uniform GST rate of 12% is hopeful. If the GST on hotel room rent and GST on restaurant food was reduced, the affordability of hotels and restaurants in India would improve, and attract tourists and create jobs. As the GST Council is in the process of deliberation, the hospitality industry in India has the potential to be a world leader in hospitality.

Also Read our insightful article on Understanding Rule 88B of CGST Rules