History of HSN Code: Meaning, Significance, and Impact in India

What is the HSN Code Meaning?

The HSN code meaning refers to the Harmonized System of Nomenclature, which is an internationally accepted system of classifying goods. The World Customs Organization (WCO) implemented this in the 1980s, and to date, has assigned over 5,000 commodity group codes. In India, HSN codes help to eliminate misinformation around taxation with an efficient tax structure under the GST and facilitate trade with other countries by allowing for detailed consistency.

To understand what the full form HSN code is {Harmonized System of Nomenclature}, it is important to grasp its purpose. Not only was this implemented to categorize products in a conformed manner, but it allows for improved trade facilitation by now providing businesses with a structured tax form.

History of HSN Code: A Global Perspective

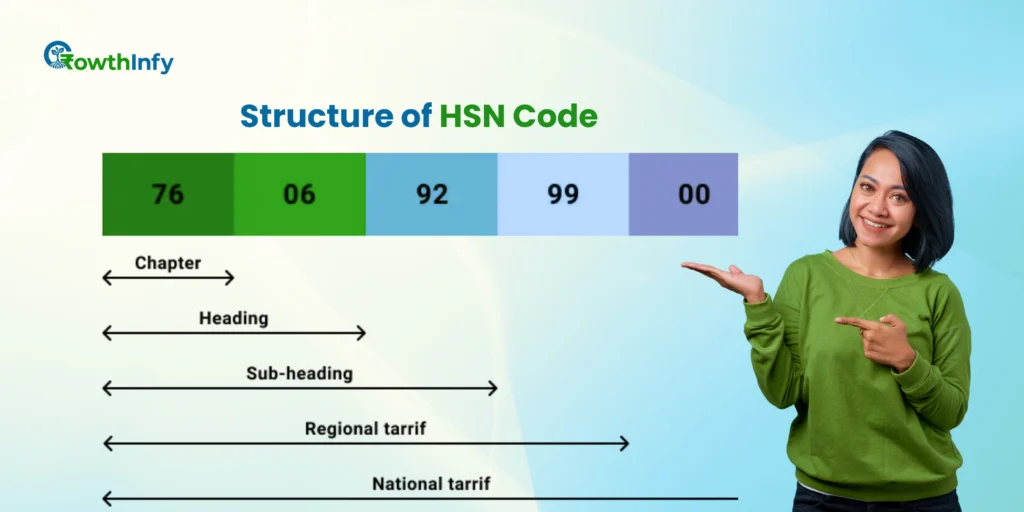

In the 1970s, the WCO developed the HSN system to standardize global trade. In 1983, the plan was formally adopted, and then it was implemented in 1988. The system organizes goods into 21 sections, 99 chapters, 1,244 headings, and 5,224 sub headings.

The HSN code is a six-digit number, but countries add additional digits for their own needs. The WCO updates the system once every 5 to 6 years to add new products, especially electronic devices, as well as remove obsolete items. More than 200 countries use HSN codes today, providing coverage for 98% of global trade.

HSN Code in India: Evolution and Adoption

India became a member of the WCO in 1971 and began implementing HSN codes for Customs and Central Excise purposes in 1986. India initially operated with six-digit codes, but later moved towards eight-digit ITC-HS codes to allow for precision ‘classification‘.

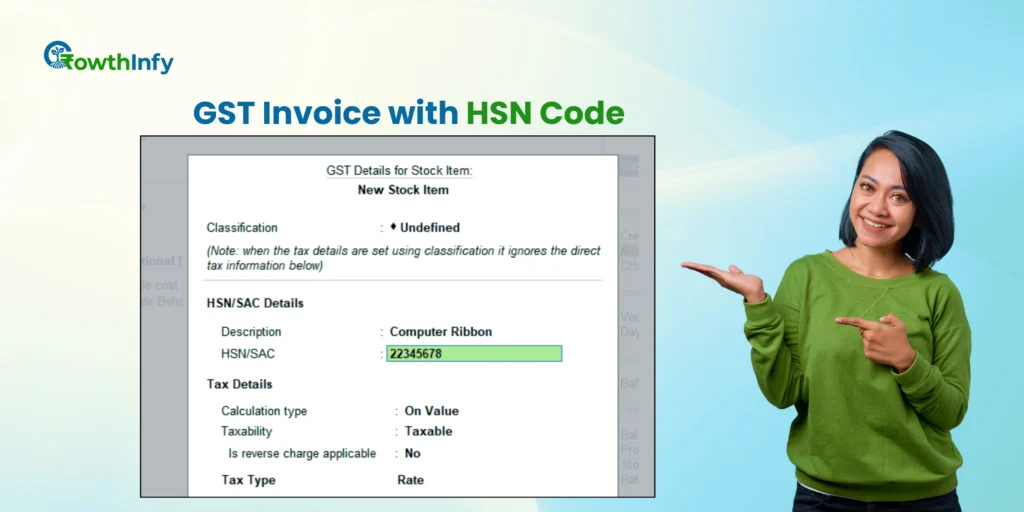

With the implementation of GST (Goods and Services Tax) in 2017, the HSN code was made mandatory as businesses had to classify their goods in their invoices and in their GST returns. The full form of HSN—Harmonized System of Nomenclature—was becoming prominent as businesses continued to align with GST compliance.

As an example, cement is classified under HSN code 2521, which legally determines the applicable GST rate. Businesses with turnovers more than ₹ 1.5 crore must use HSN codes in their filing.

Significance of HSN Codes in GST India

HSN codes play a vital role in GST and HSN code compliance. They ensure accurate tax calculation, reducing errors in invoicing and filings. The number of digits required depends on turnover:

- No HSN code: Turnover < ₹1.5 crore (optional for B2C).

- 2-digit HSN code: Turnover ₹1.5 crore–₹5 crore.

- 4-digit HSN code: Turnover > ₹5 crore.

- 8-digit HSN code: Mandatory for imports/exports.

HSN codes also simplify HSN code search for businesses, as GST portals provide tools to find codes for specific products.

Impact of HSN Codes on Businesses

By implementing HSN codes, Indian businesses are able to simplify their operations. HSN codes bring transparency to the taxation process thereby removing the possibility of tax withholding (no more 10% charged). HSN codes work for all products alike in the same methodical systemic way. HSN codes give exporters/importers an eight-digit HSN code to make sure that everybody is on the same page when classifying products, which inevitably allow faster customs clearance in foreign countries. Similarly, businesses use HSN codes to track their inventory movement, sales analysis and internal inventory management. For example, an electronic goods retailer using HSN code 8517, can easily track his stock in all detailed category and produce necessary accounting attributes. The use of automated GST software also integrates HSN codes with GST process allowing businesses a faster and more efficient process while removing the potential human error.

How to Find HSN Codes in India

Finding the right HSN code is easy with online searches. The GST portal additionally provides an HSN code search option, where a business is able to input the details of the product and receive its HSN code. Other sites like ClearTax and IndiaFilings also provide HSN code lookup as a free service.

If you want to look up the HSN code for a laptop, simply search for “laptop“ on the GST portal, and you will receive HSN code 8471. It is wise to always look up the code to ensure compliance with GST.

Why HSN Codes Matter for Indian Businesses

The HSN Code meaning goes beyond taxation. It aids in trade efficiency by establishing a common language between customs authorities. When a universal code is used, there are fewer disputes and it speeds up international trade.

The HSN Code also assists the government in collecting trade stats to develop better economic policy. For the consumer, correct usage of HSN code ensures fair pricing, as businesses are charging the appropriate GST rate.

Challenges and Tips for Using HSN Codes

Although HSN codes help bring clarity to taxation, businesses run into problems with identifying the correct codes for complex products, and they risk incurring GST penalties by using obsolete or incorrect codes.

Here are a few compliance tips for registering HSN codes:

- Use the HSN code search function on the GST portal to verify accuracy and completeness of codes.

- Use the HSN code periodically, as the WCO updates the codes approximately every 5–6 years.

- Consult a tax professional in the case of high-value or imported goods.

HSN Code vs. SAC Code: What’s the Difference?

HSN codes classify all the goods and Services Accounting Codes (SAC) classify all the services that are applicable under GST. For example, legal services are classified into SAC code 9982. However clothing is assigned an HSN code (in this case, it would use HSN code 61XX). HSN codes and SAC codes are different forms of classification system and apply taxes based on what is classified, but they apply to different categories of goods or services.

Understanding the full form of HSN code and SAC is important to help businesses appropriately distinguish goods from services and avoid tax compliance breach.

Future of HSN Codes in India

The HSN system will adapt to global changes in trade. The WCO’s periodic updates allow for relevancy for new products (to include AI devices or renewable energy) or marketplaces. In India, as GST processes become increasingly digitized, HSN codes will further converge with e-invoicing and automation.

Companies must keep abreast of GST and HSN code changes to remain compliant. GST software and government portals will assist companies in keeping regulatory abreast.

Conclusion

The HSN code, which stands for Harmonized System of Nomenclature, is more than just a title but shows it is a worldwide standard for goods classification. In India, the details of HSN codes are essential to GST compliance, international trade and business operation.started in 1986 and then rolled into service under GST in March of 2017, HSN codes have reshaped taxation and trade.

If one understands the meaning of HSN code and utilizes options like an HSN code searcher, they can be sure to compliance while enhancing and streamlining their operations. Understand how updates will affect using HSN codes for success in India‘s busy economy.

Pingback: GST on E-Commerce: What Sellers and Buyers Should Know - Growthinfy