Prime Minister’s Employment Generation Programme (PMEGP)

The Prime Minister‘s Employment Generation Programme (PMEGP) is an innovative initiative of Government of India, to promote commitment and provide sustainable livelihoods to both rural and urban areas. Launched in 2008, PMEGP was established to merge the two former schemes of the Prime Minister‘s Rojgar Yojana (PMRY) and the Rural Employment Generation Programme (REGP) to promote financial assistance through credit linked subsidies to establish micro-enterprises in the non-farm sector. The PMEGP is administered through the Ministry of Micro, Small and Medium Enterprises (MoMSME).

Although PMEGP provides financial assistance across India, the Programme is administered at the national level by the Khadi and Village Industries Commission (KVIC) while at the State level through the Directorates of KVIC, the State Khadi and Village Industries Boards (KVIBs) and the District Industries Centres (DICs).

This article provides insights into the workings of PMEGP, including eligibility, loan details, PMEGP online application status, and the PMEGP loan rate of interest for prospective entrepreneurs in India.

What is PMEGP?

The Prime Minister‘s Employment Generation Programme (PMEGP) aims to help unemployed youth, traditional artisans, and first-generation entrepreneurs for financial help to set up micro enterprises. This is facilitated by providing loans with subsidized rate of interest to create self-employment and lower dependency on informal lenders. As on 31st March 2023, PMEGP supported 8.58 lakh enterprises providing on to approx. 70 lakh jobs with an outlay of ₹2,700 crore for the 2023-24 financial year.

The scheme covers the entire economy, both rural and urban, but has a passion to encourage rural development to reduce migration to urban areas. All sectors are supported – except the negative list of meat processing businesses, liquor related businesses and few agricultural activities.

Objectives of PMEGP

The Prime Minister‘s Employment Generation Programme has established goals as follows:

- Employment Generation: Generate sustainable job opportunities in both rural and urban areas through micro-enterprises.

- Artisan Support: Increase the ability of traditional artisans and unemployed to earn.

- Entrepreneurial Development: Enhance opportunities for first-generation entrepreneur businesses to thrive.

- Reduce Migration: Provide local livelihoods to decrease migration from rural to urban.

The PMEGP, by meeting the goals outlined above, will contribute to the economic development of India and regional development.

Eligibility Criteria for PMEGP

To be eligible for the PMEGP, applicants must be classified as follows:

- Individuals: Must be over the age of 18. Applicants should have passed the minimum VIII standard if they are applying for a project over ₹10 lakh (manufacturing) or ₹5 lakh (business/service sector).

- Institutions: Self-Help Groups (SHGs), societies registered under the Societies Registration Act of 1860, production-oriented co-operative societies, and charitable trusts.

- Exclusions: Existing units that were established with support from PMRY, REGP, or other Government schemes, or which have benefited through subsidies from other Central/State Schemes.

- Project Limits: Should not exceed ₹1 lakh per capita in plain areas and ₹1.5 lakh per capita in hilly areas.

Only one person per family (self and spouse) can claim the scheme.

Loan Details and Subsidy Structure

The PMEGP loan is a credit-linked subsidy programme, with the following financial structure:

Category | Maximum Project Cost | Subsidy (Rural) | Subsidy (Urban) | Own Contribution |

Manufacturing Sector | ₹50 lakh | 35% (Special), 25% (General) | 25% (Special), 15% (General) | 5% (Special), 10% (General) |

Business/Service Sector | ₹20 lakh | 35% (Special), 25% (General) | 25% (Special), 15% (General) | 5% (Special), 10% (General) |

Second Loan (Upgradation) | ₹1 crore (Manufacturing), ₹25 lakh (Service) | ₹15 lakh (Manufacturing), ₹3.75 lakh (Service) | ₹20 lakh (NER/Hill States) | As per bank terms |

- Special Category: Includes SC/ST, OBC, women, minorities, ex-servicemen, physically handicapped, and those in North Eastern Region (NER), hill, and border areas.

- Repayment Period: 3–7 years after a moratorium period, as decided by the lending bank.

- Collateral: Loans up to ₹10 lakh are collateral-free and covered under the Credit Guarantee Fund for Micro and Small Enterprises (CGFMU/CGTMSE).

The PMEGP loan rate of interest typically ranges between 11% and 12%, aligning with regular Micro and Small Enterprises (MSE) loan rates. However, specific rates depend on the lending institution’s policies.

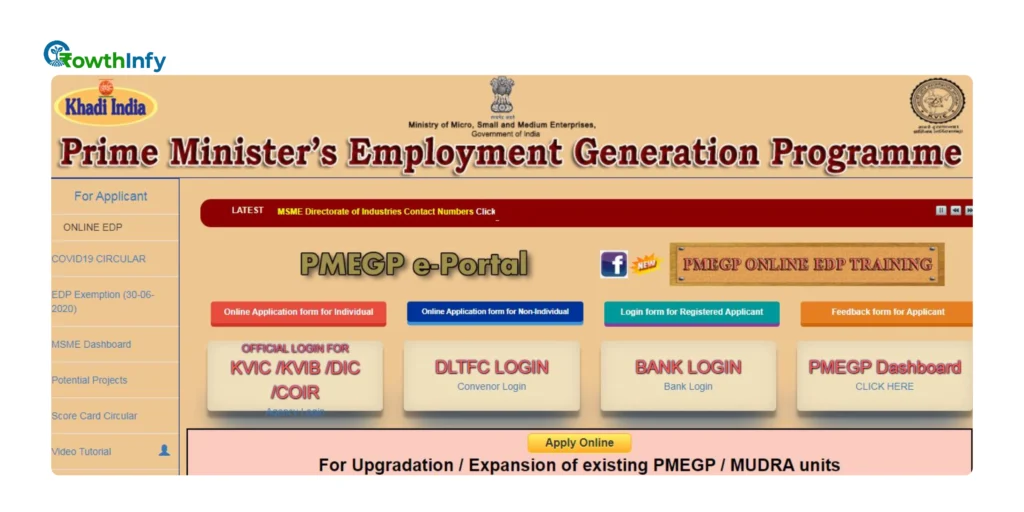

PMEGP Online Application Process

Applying for a PMEGP loan is straightforward through the official PMEGP e-portal (kviconline.gov.in). Here’s a step-by-step guide:

- Visit the Portal: Go to kviconline.gov.in and select “Prime Minister Employment Generation Programme” or “PMEGP ePortal.”

- Choose Application Type: Click on “Online Application Form for Individual” or “Non-Individual” as applicable.

- Fill Details: Provide personal, project, and financial details, including Udyog Aadhaar Memorandum (UAM) registration.

- Submit Documents: Upload required documents like Aadhaar, PAN, educational certificates, project report, and caste certificate (if applicable).

- Submit Application: Review and submit the application to the nearest KVIC, KVIB, or DIC office.

- Track Status: Check the PMEGP online application status on the portal using your application ID.

Applications can also be submitted physically at implementing agency offices. A mandatory two-week Entrepreneurship Development Programme (EDP) training is required post-approval.

Checking PMEGP Online Application Status

To track status of your PMEGP application online, please do the following:

Go to kviconline.gov.in

- Go to “PMEGP ePortal” click on “Track Application Status”

- Enter Application ID and registered mobile number.

- You can view the status of your application which can be under stages such as; Under Review, Sanctioned, Disbursed, etc.

An e-tracking application to enable transparency about the application process and to keep applicants well-engaged and educated about their application progress.

PMEGP Loan Rate of Interest

The PMEGP loans have different interest rates depending on the bank, and the average rates of 11% to 12% are in line with regular MSE loans. For example, State Bank of India (SBI) charges PMEGP loans at an effective rate of 12.15% (EBLR + 3.25%). Some banks can provide concessional rates for specific categories, for example SC/ST or women, as low as 5% for different schemes like artisan loans. Subsidy eases effective repayment because this will be adjusted after a three-year lock-in period.

If you want to know more about Pradhan Mantri Mudra Yojana read this our insightful article.

Benefits of PMEGP

Benefits of the PMEGP are manifold:

- Subsidized Loans : The substantial real term up to 35% subsidy is minimized the financial commitment for entrepreneurs.

- Collateral-free Loans : Loans of up to ₹10 lakh do not need collateral alleviating access to capital.

- Wide Coverage : Loans for any industry areas including manufacturing, and retail (except listed negative lists).

- Rural Growth : Increased subsidies for project implementation in rural areas enhances entrepreneurship.

- Job Creation : Generates holistic jobs as sustainable skilled employment especially for artisans and young people.

With its wide-applicability, PMEGP is a core element of the MSME ecosystem in formally benefitting entrepreneurs and enabling more people to participate in the economy.

Challenges and Considerations

While PMEGP has several benefits, some of its limitations are:

- Limited Funding : The project cost ceilings may affect larger projects.

- Documentation: The level of detail in project reports and compliance may be overwhelming for truly novice entrepreneurs.

- Awareness: There is often a lack of knowledge about the scheme‘s benefits among eligible candidates in rural regions.

- Negative List: Some sectors, such as liquor or tobacco-related business, are not eligible, restricting the scope.

Some of these challenges could be resolved by seeking advice and clarification from the KVIC or DIC offices in addition to using information and guidance from online resources.

How PMEGP Stands Out

PMEGP (Prime Minister’s Employment Generation Programme) is different from other schemes like the MUDRA loan or Standup India because it focuses on micro-enterprises and offers substantial subsidies. While MUDRA loans offer loans up to ₹10 lakh without subsidies, PMEGP offers higher limits up to ₹50 lakh with margin money support. The thrust of PMEGP on rural development and improvement of artisans who mostly run micro-enterprises makes it apt for small-scale entrepreneurs.

Also read our detailed guide here to understand how collateral-free loans under the Pradhan Mantri Mudra Yojana (PMMY) are helping small businesses.

Success Stories

PMEGP has changed lives throughout India. For example, a women-led SHG in Assam set up a handloom unit with a ₹20 lakh PMEGP loan, hired 15 local artisans, and became profitable two years later. Likewise, a young entrepreneur in Tamil Nadu has set up a food processing unit – using a ₹15 lakh PMEGP loan – and employed 10 workers. These examples demonstrate PMEGP‘s power at the grassroots level for entrepreneurship.

Conclusion

The Prime Minister‘s Employment Generation Programme (PMEGP) is a game-changer for aspiring entrepreneurs in India. As a micro–business perspective, PMEGP provides you with low interest loans, generous subsidies all with a focus on sustainable employment. Imagine bringing your business ideas to life. For individuals and applicants who wish to apply, PMEGP provides an e-portal for new applications and monitoring PMEGP online application status. A PMEGP loan typically has a rate of interest between 11% and 12% found between banks and financial institutions but can provide generous subsidies for micro-businesses.

The PMEGP programme may be useful for unemployed youth, traditional artisans or first-time entrepreneurs. To get started, take a look at kviconline.gov.in to apply and it all starts with your mind state on the journey to financial independence.