Growthinfy Startup and Allied Services

Business Incorporation

Kick-start your business the correct way with Growthinfy's reliable incorporation services. We help register Private Limited Companies, LLPs, OPCs, and Partnership firms with complete legal and regulatory compliance. Our professionals handle name reservation, DIN/DSC acquisition, document preparation, and MCA filing. We also offer post-registration assistance to ensure a smooth start of operations. With Growthinfy, you have end-to-end support to establish a legally compliant and future-proof business.

Which business form do I pick—Private Limited, LLP, OPC, or Partnership?

The optimal form varies with ownership, planned funding, preferred liability, and compliance requirements. We guide you to pick the best for your needs.

What is the timeframe for company registration in India?

7–15 working days typically, subject to documentation, name clearance, and MCA processing time.

What are the documents needed for incorporation of a business?

Identity and address proof of directors/partners, registered office proof, suggested business name, and digital signatures are required.

Does GST registration come as part of the incorporation package?

GST registration is provided as an additional service by us, and our team can help you immediately after incorporation to become tax compliant.

Can I incorporate my company online via Growthinfy?

Yes, we provide 100% online incorporation services with step-by-step instructions and document processing through secure digital channels.

MSME Registration

Get access to government benefits and scale your business with Growthinfy's seamless MSME registration solutions. We lead small enterprises and startups through the Udyam registration, which opens the doors to credit assistance, subsidy support, and tax relief. We facilitate easy, accurate, and speedy registration to allow you to concentrate on scaling your business. MSME registration is simple, fast, and cost-effective with Growthinfy, which puts the services you need right at your fingertips.

What is MSME registration, and why is it important?

MSME registration (Udyam registration) gives small and medium enterprises access to government schemes, subsidies, reduced interest rates on loans, and tax benefits.

What are the eligibility criteria for MSME registration?

Companies engaged in manufacturing or services and having turnover under ₹250 crore (manufacturing) or ₹100 crore (services) may apply.

What is the duration of completing MSME registration?

MSME registration via the Udyam portal will take between 1-3 days if all the documents needed are ready.

Is MSME registration compulsory for small businesses?

MSME registration is not obligatory but highly suggested to avail government incentives, schemes, and benefits for registered MSMEs.

What are the documents needed for MSME registration?

You will require your Aadhaar number, PAN, proof of business address, and bank account information to finalize MSME registration.

Bookkeeping & Accounting

Let Growthinfy take care of your accounting and bookkeeping services so that you can focus on expanding your business. We provide customized solutions for startups and SMEs with proper financial records, timely monthly statements, and professional assistance. Our experts ensure you comply with tax and regulatory obligations, give you insights for informed business decisions, and take the hassle off your hands. With Growthinfy, you have trusted, stress-free accounting services that make your financial transactions efficient and compliant.

How is bookkeeping different from accounting?

Bookkeeping is the process of recording daily financial transactions, whereas accounting is summarizing, interpreting, and analyzing financial data to present reports for business decision-making.

How can bookkeeping benefit my business?

Proper bookkeeping ensures that you record all income and expenses, stay compliant with tax laws, and produce detailed reports for improved financial planning.

Do I require professional accounting for a small business?

Yes, professional accounting assists with precision, penalty avoidance, tax efficiency, and profitable insights for business development.

What reports can I access with bookkeeping services?

Monthly balance sheets, profit & loss, cash flow, and tax-compliant financial statements.

How can Growthinfy's bookkeeping services help my startup?

We organize your financial procedures, keep clean records, meet tax requirements, and give the financial information needed to make decisions as your company expands.

MCA & Compliance

Remain completely compliant with corporate regulations through Growthinfy's professional MCA and compliance services. We handle annual returns, ROC returns, director KYC, and other regulatory compliances to ensure your company remains in compliance with all statutory requirements. Our experts actively track legal updates and notify you in a timely manner, so you do not incur penalties and legal liabilities. With Growthinfy, you have trustworthy assistance to keep operations running smoothly and compliantly, so you can relax.

What is the MCA, and why is compliance important?

The Ministry of Corporate Affairs (MCA) is the government body that regulates company law in India. MCA compliance ensures that your business follows legal guidelines, avoiding penalties and ensuring smooth operations.

What is the process for annual filings with the MCA?

Annual filings involve filing the financial statements of the company (Balance Sheet, P&L), directors' report, and other documents with the Registrar of Companies (ROC) using the MCA portal.

What is Director KYC, and is it compulsory?

Director KYC is the process of identifying company directors using the MCA portal. It is compulsory for all directors to undergo their KYC to ensure compliance.

What are the consequences of non-compliance with MCA rules?

Non-compliance can lead to fines, penalties, and disqualification of directors, and suspension of business operations.

How frequently do I have to file with the MCA?

Companies have to file annual accounts and other regulatory returns annually. Filings may also be needed for events like appointment of directors or share allotments.

Our Commitment

At Growthinfy, our passion lies in delivering innovative, market-fit courses that equip learners with the skills and knowledge needed to acquire financial stability and unlock their growth opportunities.

We are committed to providing affordable, expert financial and taxation services that ease business finances and enable sustainable success.

Supplementing this, we deliver high-quality, well-researched knowledge to enable individuals to make sound financial and business decisions—enabling our vision of a financially free and empowered India.

Find Growthinfy on

Talk to Our Expert

Schedule a call with our team for tailored advice and solutions.

- Free consultation

- Priority support access

- Startup consultation sessions

What our Clients Say

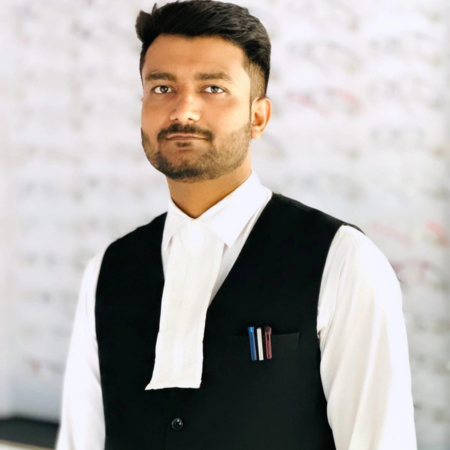

Adv. Dhirendra Pratap Singh

Harshit Kumar

Abhay Yadav